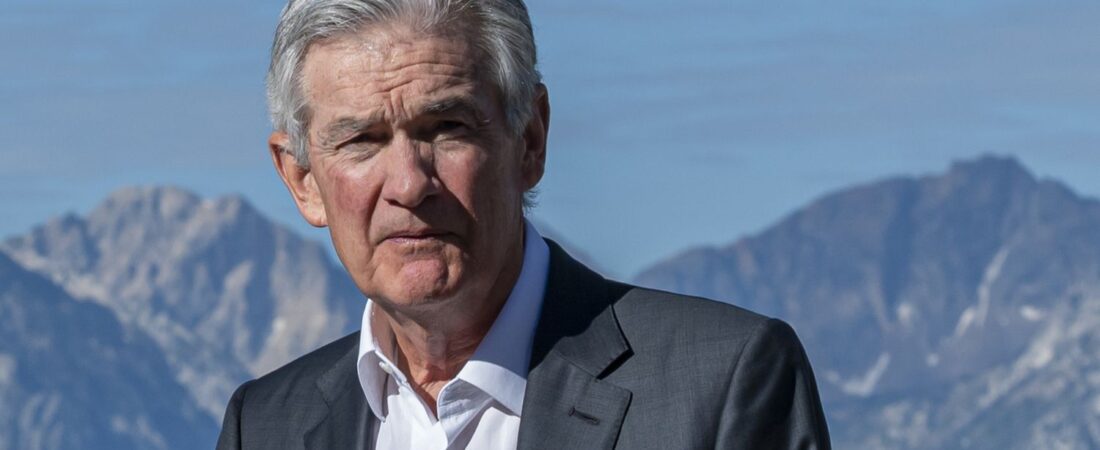

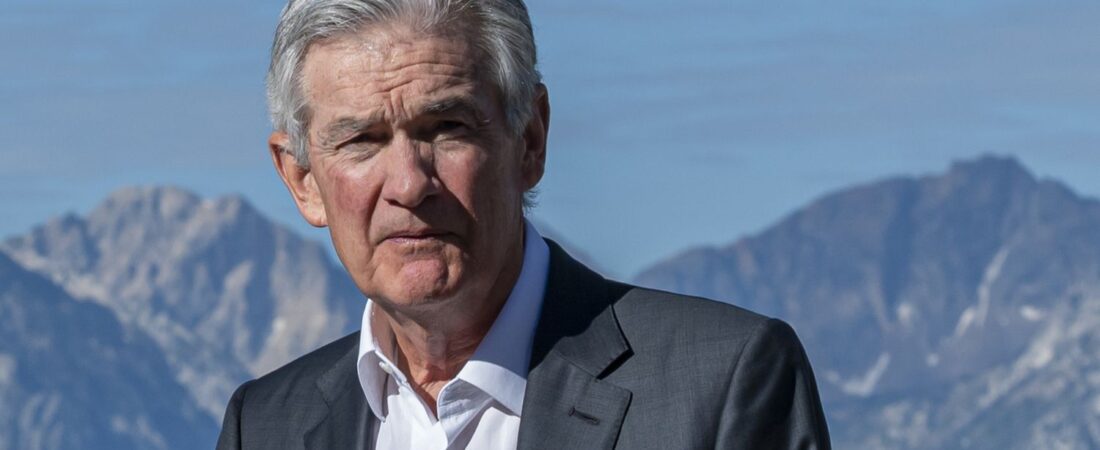

Crypto Market Reaction: Traders Brace for Jackson Hole Symposium and Powell’s Economic Guidance

Crypto markets showed mixed performance ahead of the highly anticipated Jackson Hole symposium, with traders closely monitoring Federal Reserve Chair Jerome Powell’s upcoming speech for guidance on economic policy and its impact on risk assets. Bitcoin experienced significant volatility, briefly dipping below $113,000 before rebounding, as investors adjusted their positions in response to increased uncertainty and intensifying dollar strength.

The week saw sharp declines across leading cryptocurrencies following the release of the Fed’s July meeting minutes, which signaled a more cautious economic outlook. Bitcoin dropped 3.2% to below $114,000, while Ethereum fell over 5% to under $4,200. This pullback was felt across the broader market, with Ripple, Cardano, and Solana also posting substantial losses.

Market volatility triggered a wave of liquidations, with more than $450 million wiped out and over 120,000 traders forced to close positions. Leveraged longs were hit particularly hard, amplifying the downturn and highlighting the heightened risk environment as investors braced for Powell’s remarks.

The Jackson Hole speech is widely seen as a pivotal event, as Powell’s tone on growth and future policy can reset sentiment across both traditional and digital assets. Historically, hawkish signals from Jackson Hole have led to risk-off moves, while dovish guidance has sparked rallies. The US dollar’s recent strengthening poses an additional headwind for Bitcoin, as crypto assets tend to perform better when the dollar softens.

With traders hedging their bets and trimming exposure ahead of the symposium, the market’s reaction will largely depend on Powell’s message. Whether this week’s selloff becomes a healthy pause in a bull market or marks the start of a deeper correction hinges on the outcome of this crucial Fed event.

コメントを書く